Peloton’s Turnaround Playbook: Marketing, Gyms, and the Future of Fitness

Peloton reported earnings again last week, and the story barely changed. Revenue beat expectations. Losses did too. Investors shrugged and moved on. Same movie, new quarter.

The core problem is not getting people to try Peloton. That part has always been easy. The problem is converting trials into real commitment. A free month is fun. A subscription is a lifestyle. Peloton still struggles to bridge that gap.

So the bigger question becomes clear. How do you take a company that once defined pandemic fitness culture and turn it into a sustainable business with long-term retention?

To get there, you have to break the business down in pieces.

1. Peloton’s business today

Here is the twist. A lot of Peloton’s recent moves actually make sense.

They hired Leslie Berland, the former CMO of Twitter. And you could see the shift immediately. Gone were the surreal penthouse ads with massive windows, tastefully expensive sofas, and a golden retriever placed like a West Elm prop. In their place: garages, cramped corners, bikes shoved next to laundry machines, people sweating between Zoom calls. For once, Peloton looked like real life.

Is that less aspirational? Shouldn’t a fitness brand sell the dream?

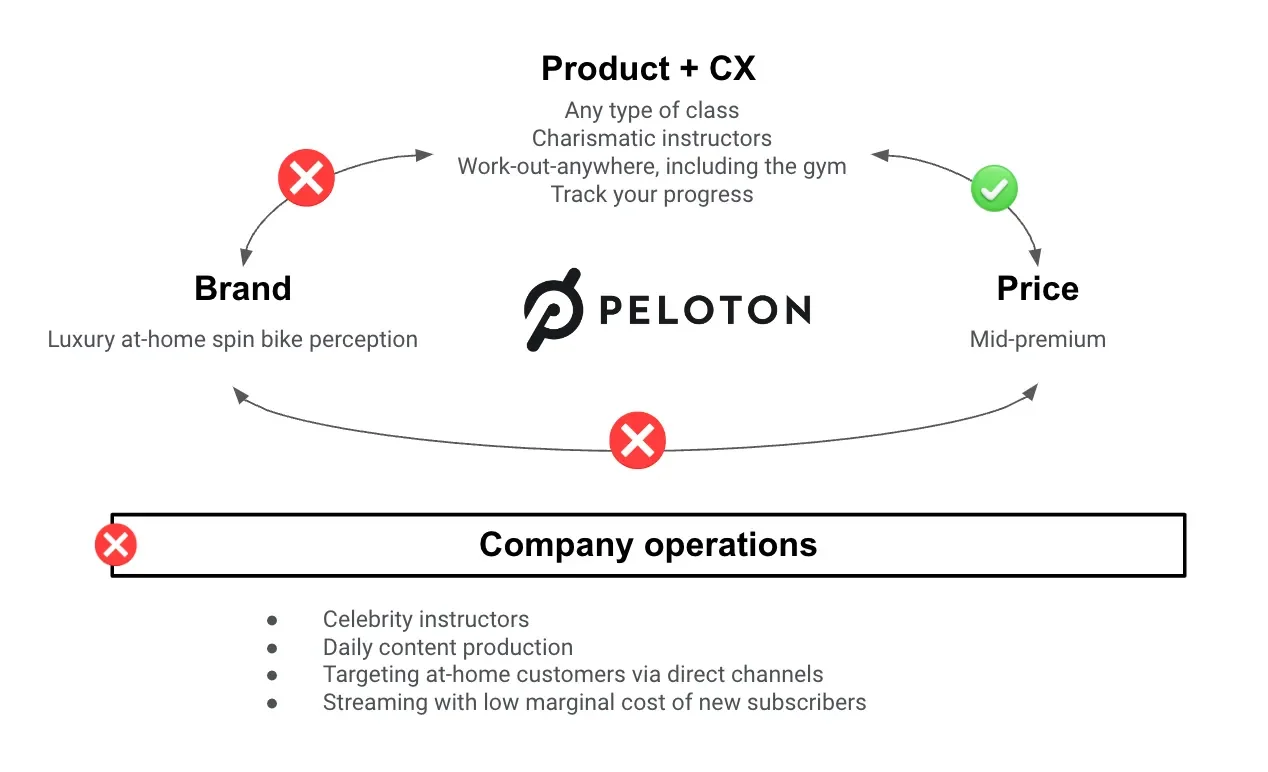

No. Peloton oversold the dream for years. Their actual model is closer to Netflix. You pour money into content and recover it by scaling across millions of people. Mass-market brands cannot act like Hamptons-only clubs.

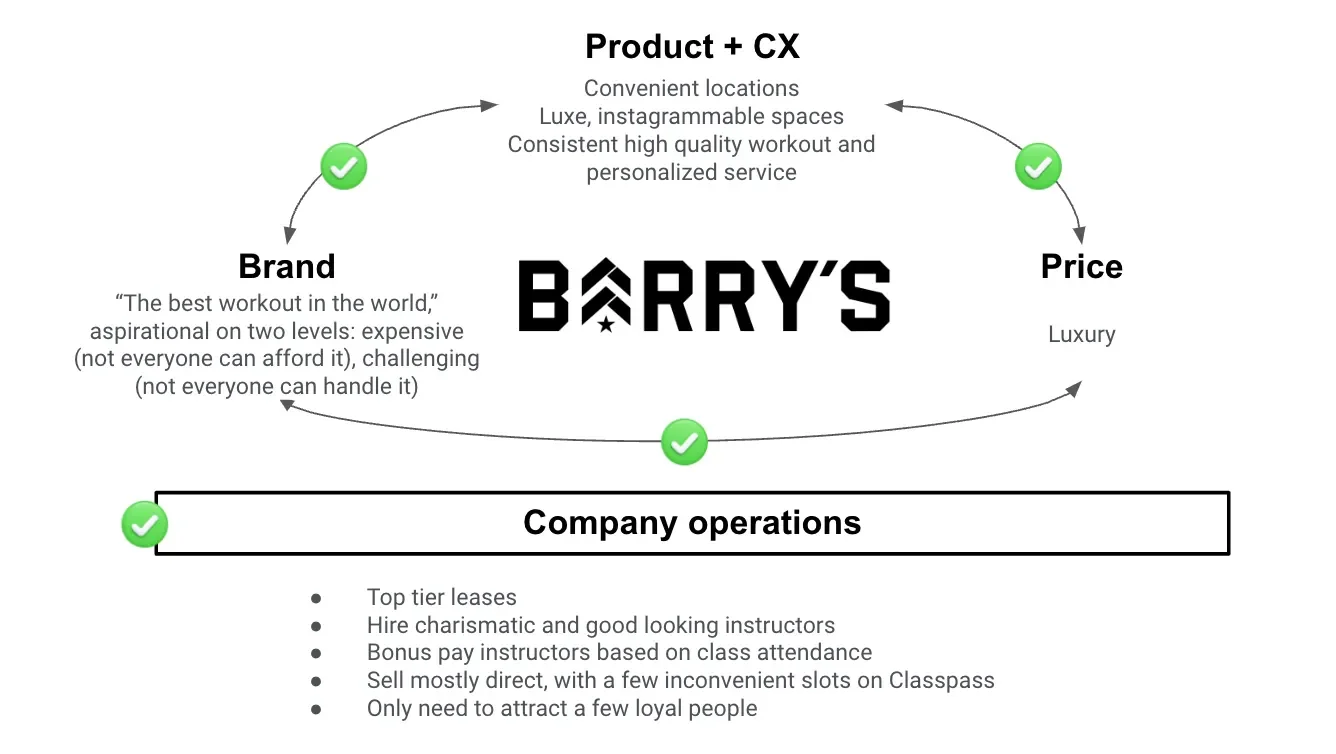

Barry’s Bootcamp can. Barry’s depends on scarcity. Limited spots, high prices, luxury touches. That is the flywheel. Peloton’s is the opposite.

And Peloton’s flywheel? Right now, it wobbles.

The luxury perception problem

Peloton is still seen as a luxury product. But the math does not match that image. The bike costs $1,445. The all-access subscription is $44 a month. Keep it two years and it costs roughly $105 a month for unlimited classes. That is the price of two and a half Barry’s sessions. The digital-only subscription is $24.99. Cheaper than cable.

Luxury in perception. Premium in reality.

The spin-bike problem

Peloton offers strength, barre, yoga, meditation, boxing, Pilates, rowing, running, stretching. The list keeps growing. People still default to the same mental shortcut: Peloton = bike.

Perception blocks discovery.

The at-home stigma

This is the stickiest issue. During lockdowns, Peloton became the perfect at-home solution. Once gyms reopened, everything flipped. Now it became a binary choice: gym person or Peloton person. That binary cuts Peloton off from the exact market most willing to spend on fitness: people who already work out.

Chasing non-exercisers is the hardest possible acquisition strategy. It’s like opening a steakhouse and deciding your primary audience is vegans.

The fix is obvious. Break the binary. Stop positioning Peloton as a gym replacement. Start positioning it as a gym complement.

Nike already cracked that playbook. Nike Training Club never asked people to quit the gym. It fit into the gym. Peloton could do the same.

2. Peloton’s marketing challenges

Once you map Peloton’s Brand Flywheel, the weak points become clear. Four challenges, all connected.

Challenge 1: Shift perception from luxury to premium

Peloton has already started doing this with more grounded settings and everyday environments. But perception always lags reality. If the world assumes you are a Hermès scarf when you are just a nice J.Crew sweater, you live in the wrong tax bracket.

Challenge 2: Shift perception from spin-only to full fitness

Peloton keeps trying to show breadth with glossy montage ads. Great soundtrack. Great sweat. But “look at everything we have” is not a strategy. It is a list.

Challenge 3: Peloton needs a story

People know the name. They remember the pandemic boom, the memes, the Christmas ad. They do not know why Peloton matters now. Brand energy froze in 2020. A brand without a new narrative becomes cultural background noise.

Challenge 4: Get into gyms

Distribution shapes brand. Peloton only appearing in homes keeps it niche. Peloton showing up in gyms unlocks an entirely new audience. If Moncler could use retail placement to evolve from ski gear to luxury staple, Peloton can use gyms to evolve from “bike company” to full-scale fitness platform.

3. How to solve all four challenges

The first three issues can be solved with a single creative strategy. The fourth is a distribution shift. Combine them and the flywheel starts spinning again.

Campaign idea 1: Mental health is physical health

Most people do not work out for aesthetics. They work out so they do not feel terrible. And the research backs it up. Movement is one of the most reliable ways to improve mental health.

Peloton could own this space. They already have instructors who talk openly about emotional wellbeing. Imagine Peloton standing for “mental health through movement.”

That platform scales across everything the app offers. Yoga, cardio, meditation, running, strength. Instead of “we also have X,” it becomes “we help you feel better, however you want to move.”

Campaign idea 2: Pelostrong

A cheeky stunt can reset perception. If Peloton temporarily rebranded as Pelostrong, it would be ridiculous in the best way. IHOP once changed to IHOB. People laughed. Sales jumped.

Highlight the strength category. Highlight real transformation stories. They exist everywhere, especially on Reddit. Package them. Give Peloton a second cultural wave.

If that feels too loud, split the app into something like “Strong by Peloton.” A clean signal that Peloton is more than cycling.

Distribution idea: Put Peloton inside gyms

Gyms do not want to build content platforms. Peloton does. A hybrid revenue-sharing app solves the problem for both sides. Gyms get stickier members. Peloton gets an audience already paying for fitness.

Even better: if a member leaves the gym but stays with Peloton, the gym still earns a cut of the subscription. Losing a member but keeping recurring revenue? That is an easy pitch.

The path forward

Peloton can move past the pandemic caricature. They can shake off the “bougie bike” reputation. They can become the platform for feeling good through movement.

Not just the Netflix of fitness. The platform that makes sense.

And the answers have been hiding in plain sight. In Reddit posts. In garage-bike ads. In messy living rooms. In the way people actually use the product.

What would you do to turn Peloton around?